1. Scope

This Consumer Duty Policy applies to all operations and interactions between AB Money and its customers. It encompasses the provision of foreign exchange (FX) brokerage services and all related activities, including but not limited to account opening, transaction execution, customer support, complaints handling, and product offerings. This policy is applicable to all customers, irrespective of their geographical location, and is designed to ensure that customers receive fair treatment, clear information, and suitable products and services from AB Money.

2 Introduction

AB Money is a reputable FX Broker Company that provides exceptional foreign exchange services while prioritizing the protection and satisfaction of our customers. In accordance with the guidelines set forth by the Financial Conduct Authority (FCA), this comprehensive Consumer Duty Policy outlines our commitment to upholding the highest standards of consumer protection and ensuring that our customers are treated fairly and transparently throughout their engagement with us.

At AB Money, we recognize the importance of establishing a strong and trustworthy relationship with our customers. We aim to go beyond regulatory requirements by adhering to the Consumer Duty principles and implementing cross-cutting rules that prioritize the best interests of our customers. This policy covers a wide range of areas, including suitability, clear information disclosure, complaints handling, financial safeguards, and continuous improvement.

By implementing this robust Consumer Duty Policy, we aim to instil confidence in our customers, demonstrate our commitment to their well-being, and ensure that our products and services meet their unique needs and preferences. We believe that by acting with integrity, transparency, and professionalism, we can build enduring partnerships with our customers based on mutual trust and satisfaction.

This policy serves as a guiding framework for our employees, outlining their responsibilities and obligations towards our customers. It also provides a clear roadmap for AB Money's ongoing commitment to enhancing our processes, maintaining compliance, and continuously improving the quality of service we provide to our valued customers.

Through the effective implementation of this Consumer Duty Policy, AB Money endeavours to set new benchmarks in the FX brokerage industry by consistently delivering exceptional customer experiences, fostering transparency, and promoting a culture of trust and fairness in all our interactions.**

3. Understanding Consumer Duty

AB Money is committed to upholding the principles of the Consumer Duty, which applies to the entire customer journey, from initial engagement to ongoing support. The Consumer Duty principles encompass the following:

Best Interest: AB Money will always act in the best interest of its customers, ensuring that their needs and preferences are considered when providing services and recommending products.

Suitability: AB Money will assess the suitability of its products and services for each customer, taking into account their individual circumstances, risk appetite, and objectives.

Clear Information: AB Money will provide customers with clear and understandable information about its services, fees, risks, terms and conditions, and any potential conflicts of interest, enabling customers to make informed decisions.

Performance: AB Money will strive to ensure that its products and services perform as customers reasonably expect, delivering the promised features and functionalities.

Prompt and Effective Service: AB Money will provide customers with timely and efficient service, addressing their queries, concerns, and complaints in a fair and reasonable manner.

Switching and Consumer Rights: AB Money will not create unnecessary barriers for customers who wish to switch products, switch providers, submit claims, or exercise their consumer rights.

Regulatory Compliance: AB Money will operate in compliance with applicable regulatory standards, providing customers with the assurance that its products and services meet the necessary requirements.

4. Cross-Cutting Rules

Treating Customers Fairly (TCF):

AB Money will prioritize fairness, integrity, and respect in all interactions with customers, ensuring that they are treated equitably and without discrimination.

Clear and Transparent Communication: AB Money will communicate with customers in a clear and transparent manner, using plain language to present information about its services, fees, risks, and terms and conditions.

Complaints Resolution: AB Money will establish a robust process for handling customer complaints, ensuring that complaints are acknowledged promptly, thoroughly investigated, and resolved in a fair and reasonable manner.

5. Suitability

Customer Needs Assessment: AB Money will make reasonable efforts to understand each customer's needs, circumstances, and objectives, enabling the provision of suitable products and services.

Ongoing Review: AB Money will regularly review and assess the suitability of its FX brokerage services for each customer, taking into account changes in their risk appetite, financial knowledge, and investment objectives.

6. Disclosure of Information

Comprehensive Information: AB Money will provide customers with clear and comprehensive information about its services, including the risks associated with FX trading, fees and charges, and any potential conflicts of interest.

Conflict of Interest Management: AB Money will identify and manage any conflicts of interest that may arise, ensuring that customers' interests are not compromised.

7. Complaints Handling

Transparent Complaints Process: AB Money will establish a transparent process for handling customer complaints, ensuring that customers are informed of the progress and receive clear explanations for any decisions made.

Fair Outcomes: AB Money will conduct thorough investigations into complaints and strive to provide fair and reasonable outcomes, taking into account the circumstances and merits of each case.

8. Financial Safeguards

- Customer Fund Protection: AB Money will maintain appropriate financial safeguards to protect customers' funds. This includes adhering to regulatory requirements regarding the segregation of customer money from the company's own funds.

- Risk Mitigation: AB Money will regularly assess and monitor the financial stability of its business to mitigate the risk of potential financial harm to customers. Adequate measures will be in place to ensure the safekeeping and proper management of customer funds.**

9. Continuous Improvement

Policy Review: AB Money is committed to regularly reviewing and enhancing its Consumer Duty Policy to align with changing regulatory requirements and industry best practices. This ensures that customers receive the highest level of protection and service.

Customer Feedback: AB Money actively seeks feedback from customers to identify areas for improvement and enhance the customer experience. Customer feedback is considered valuable in shaping policies, procedures, and practices.

10. Reflection and outcome

Rating score with comments

Once onboarded, Customer journey on products and services on account platform via mobile application or web interface. The system will automate generate ‘pop up’ the survey with satisfied score rate between 1-5 star.

| 1 star | Very Dissatisfied |

| 2 star | Dissatisfied |

| 3 star | Neutral |

| 4 star | Satisfied |

| 5 star | Excellent |

Customers feel free to give the rating score based on products/services used each time with leaving comments to AB Money team.

Log and Recording

The system has automated recording and keep in log for all rating and comments by customers.

Log recording break down.

Case ID

Report Date

Customer ID

Customer Type i.e. individual

Full name

Products/Services usages

Price / fees

Customer feedback in score i.e. Neutral, Satisfied

Customer comments

Assists or support request i.e. Yes/No and how? i.e. Yes, Support team contact customer on phone to assist how to set up beneficent account on mobile app.

Adjust Result i.e. customer changed reflect outcome after assists by support or consumer champions.

Position – states AB staff name with role to support with customers.

Action date

Devices i.e. mobile application, web browser

11. Support and Customer Assistance

The system will trigger and alert to support team and champion when customers given low rating score in 1-2 star as it reflects for Dissatisfied on products and services.

AB Money support team and champion will contact customers in different methods for ensure to help customers able to achievement requirements.

11.1 Support Line

In terms of Ages and Learning disabilities is difficult to customers for access to new technology, mobile applications, web interface. That is mean customers unable to reach, understand on products for achievement.

Customers can contact to support team for learning on products and services or assist process on behalf if necessary.

Chat support line via Facebook and Line

Telephone Call: +44 (0) 203 355 9660

- Email: info@ab-money.co.uk

11.2 Presentation and VDO

We set up VDO shot for all features and functionality on mobile applications for allow customers has clear picture and understanding with the products and services.

11.3 E-Meeting

Some vulnerable need specialists to assist and support. AB Money can set up E-meeting via Zoom for demonstration on products and services under requirements.

11.4 Debt management

In the case of Physical disability, Mental health conditions, Long-term illness or health conditions and Bereavement that unable or lack of financial income for remaining the commercial cost on products fee.

We are able to negotiate and offer the waiver monthly fees up to 90 days.

Example: The pandemic by Covid19 made customers lose job and unable to effort monthly fees.

AB Money is not bank, we cannot provide credit and loan services for vulnerable customers.

12. Fair Vule and Prices

AB Money provide fair value and prices for competitive in UK market. We published clearly on website customers can access to reviews and consider using our products and services. https://abmoneyplus.com/personal/price-tariff

Personal Account pricing and Fees standard on account platform

| Account Opening | |

| KYC Compliance & Admin proceed for GBP account | Free |

| KYC Compliance & Admin proceed for EUR account | Free |

| Person Debit Card | £10.00 |

| Monthly Charge | |

| Monthly Service Charge on GBP account | £9.99 |

| Monthly Service Charge on EUR account | €9.99 |

| Account Pricing | |

| Outgoing Bank Transfer (UK Local account) | £0.99 |

| Incoming Bank Transfer (UK Local account) | £0.79 |

| Outgoing Bank Transfer (EU SEPA) | €0.99 |

| Incoming Bank Transfer (EU SEPA) | €0.89 |

| Outgoing Bank Transfer (EU SEPA) - Urgent | €2.00 |

| Incoming Bank Transfer (EU SEPA) - Urgent | €1.00 |

| International Payment (SWIFT PAYMENT) | |

| Incoming in GBP via Swift international | £15.00 |

| Outgoing in GBP via Swift international | £25.00 |

| Incoming in EUR via Swift international | €20.00 |

| Outgoing in EUR via Swift international | €30.00 |

| Card Pricing | |

| Card Fee | £10.00 |

| Lost/ Stolen Replacement Card | £10.00 |

| ATM withdraw domestic up to £250 per time / 4 time a day | £3.00 |

| ATM withdrawal international | £10.00 |

| Debit/Credit Card deposit to account | minimum £1 or base on volume GBP 0.50% / 1.00% |

| Instant bank transfer between A&B Money account | £2.00 |

| Manual debit/credit (By Bank Staff) | Free |

| ATM Balance Inquiry | £0.99 |

| ATM PIN change | £0.99 |

| POS domestic | £0.50 |

| POS international | GBP 1.00 plus 1.00% |

| POS/ATM Decline | £0.50 |

| PIN Reveal | £2.00 |

| FX Fee (between the currency on platform) | 3.00% |

Business Account pricing and Fees standard on account platform

We published clearly on website customers can access to reviews and consider using our

products and services. https://abmoneyplus.com/plus-business-en/price-tariff-business

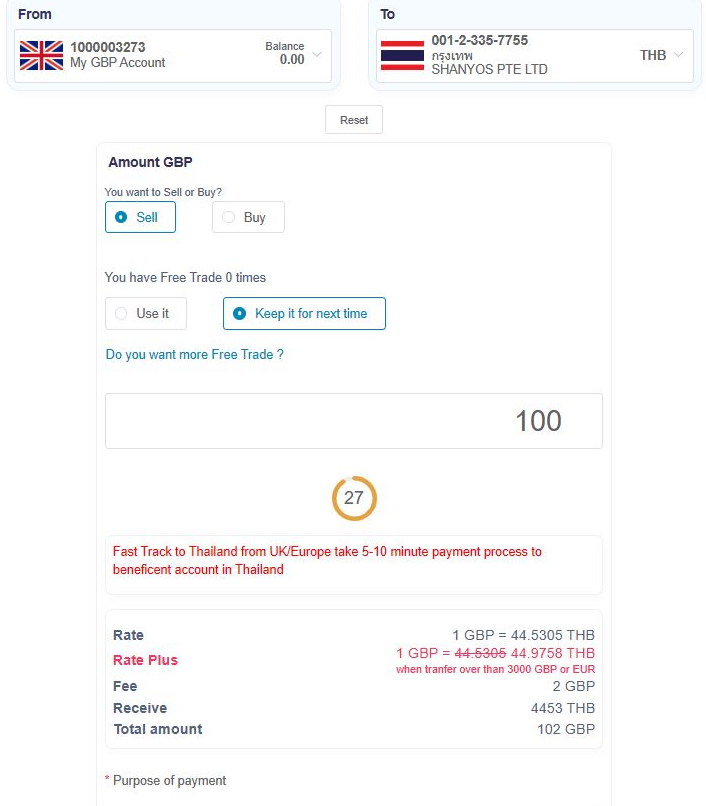

Payments international

The account platform will generate fees and exchange rate daily based on volume, country destination and live-mid market rate.

Above photo states fees and exchange rate has generated in dynamic based on different number and displayed on platform for allow customers to make decisions.

| • | Rate | Based on mid-market rate as we mark up for 40 basis points. | |

| • | Fees | Based on volume of payments i.e. 2 GBP when you send money up to 100 GBP | |

| • | Received | Amount and currency on customer need to receive in destination. |

13. Restriction and Prohibited

AB Money has conducted risk assessment and compliance controls for all customers for ensure not cross-cutting rules prescribe that ensuring AB Money act in good faith, avoid causing foreseeable harm.

Compliance Firewall

Account platform, products, and services that we provide to customers has conducts with compliance firewall for monitoring since onboarding customers, customer journey and activities to ensure its not involved with money laundering, terrorise financial transactions.

Fraud Prevention

AB Money needs to ensure a customer to engage with under ‘know your customer’ as it standard to protect our business not related with Fraudster, Forge documents.

Risk Awareness

Once we can identify the identity person or business who need become our customer.

AB Money needs to ensure a customer engages under business wide risk assessments. We need to request identity documents and UK prove of address and applicants’ information i.e. contact details, occupation, salary, expect payment volume etc.

Screen checks

All customers must pass the global PEPs, Sanction, Advised Media, and other risk screen checks. Any potential match need to be reject an application.

Documents request

We published a standard how to register and become our customer with documents

requirement here.

https://abmoneyplus.com/online-banking-plus/how-to-register-with-us

Prohibited Business and Industries

We are considered to be at potentially higher risk for money laundering and terrorist financing activities. The purpose of this document is to give all staff at AB Money guidance and remind them of their obligations under The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, Proceeds of Crime Act and Terrorism Act 2000 as set out in the AML Policy.

Including the update, the UK's AML regime to incorporate international standards set by the Financial Action Task Force (FATF) and to transpose the EU’s 5th Money Laundering Directive.

A&B General (UK) Limited - Country Risk Appetite

14. Supplier and Vendor Management

All Products and Services that AB Money provide to customers have relied on multiple business partners, Banking partners and suppliers that support our products meet the standard of regulators controls.

AB Money Plus will maintain relationships with critical suppliers and vendors and ensure that they have their own Business Continuity Plans in place. Supplier and vendor risk assessments will be conducted to evaluate their resilience and readiness to manage disruptions.

Alternate suppliers and vendors will be identified and pre-qualified to ensure the availability of critical resources and services during disruptions.

Effect to Customers

AB Money regularly process wide risk assessment in the worst-case scenario will effectively to customers if it happens.

However, its only minor that will slow down for services process if our partners have issued, server down or having business problem will effectively to our products and services that we provide to our customers as well.

Example: our website hosting server down that affect to our customers cannot access to AB Money websites.

Our Partner

Web hosting: https://www.one.com/en/

Cloud computing and server by https://www.digitalocean.com/

Secured data usage and load balance for continuity plan and back end server https://aws.amazon.com/

Card Acquirer https://www.trustpayments.com/

Safeguarding bank account https://www.crownagents.com/

Customers cannot use products and services directly to our partners. However, Customers can access on feather and functionality on products and services that AB Money provides as its API integration to our business partners.

Example: Customer access to online account via mobile application, the data usages and calculations system coding by AB Money but storing and secured by AWS.

Business Continuity Planning

AB Money Plus will develop and maintain a comprehensive Business Continuity Plan (BCP) that outlines the strategies and procedures to be followed in the event of a disruption.

The BCP will cover critical business functions, processes, and systems, and will include procedures for disaster recovery, backup and restoration of data, communication protocols, alternative work arrangements, and other necessary actions to ensure the continuity of operations. The BCP will be regularly reviewed, tested, and updated to reflect changes in business operations, technologies, and risk landscape.

Communication and Coordination

AB Money Plus will establish clear communication channels and protocols for internal and external stakeholders during disruptions. This includes regular updates to employees, customers, suppliers, vendors, regulators, and other relevant parties regarding the status of operations, expected timelines for restoration, and any changes to normal business processes.

Coordination with relevant authorities, emergency services, and other stakeholders will be established to ensure a coordinated response to disruptions.

Monitoring and Review

AB Money Plus will continuously monitor and review the effectiveness of the Operation Resilience Policy and associated plans and procedures. Any gaps or deficiencies identified will be addressed promptly, and necessary improvements will be made to enhance the resilience of operations.

Lessons learned from previous disruptions will be incorporated into the policy and plans to continuously improve AB Money Plus’s ability to manage disruptions.

Compliance and Reporting

AB Money Plus will comply with all relevant laws, regulations, and industry standards related to business continuity and resilience. Regular reporting on the status of the Operation Resilience Policy, including risk assessments, mitigation measures, testing results, and progress on improvement actions, will be provided to senior management and relevant stakeholders as required.

15. Conclusion

AB Money's Consumer Duty Policy is designed to safeguard the interests of our customers, providing them with fair treatment, clear information, and suitable products and services. By adhering to the principles outlined in this policy and continuously improving our practices, we aim to foster trust, transparency, and long-term relationships with our valued customers.